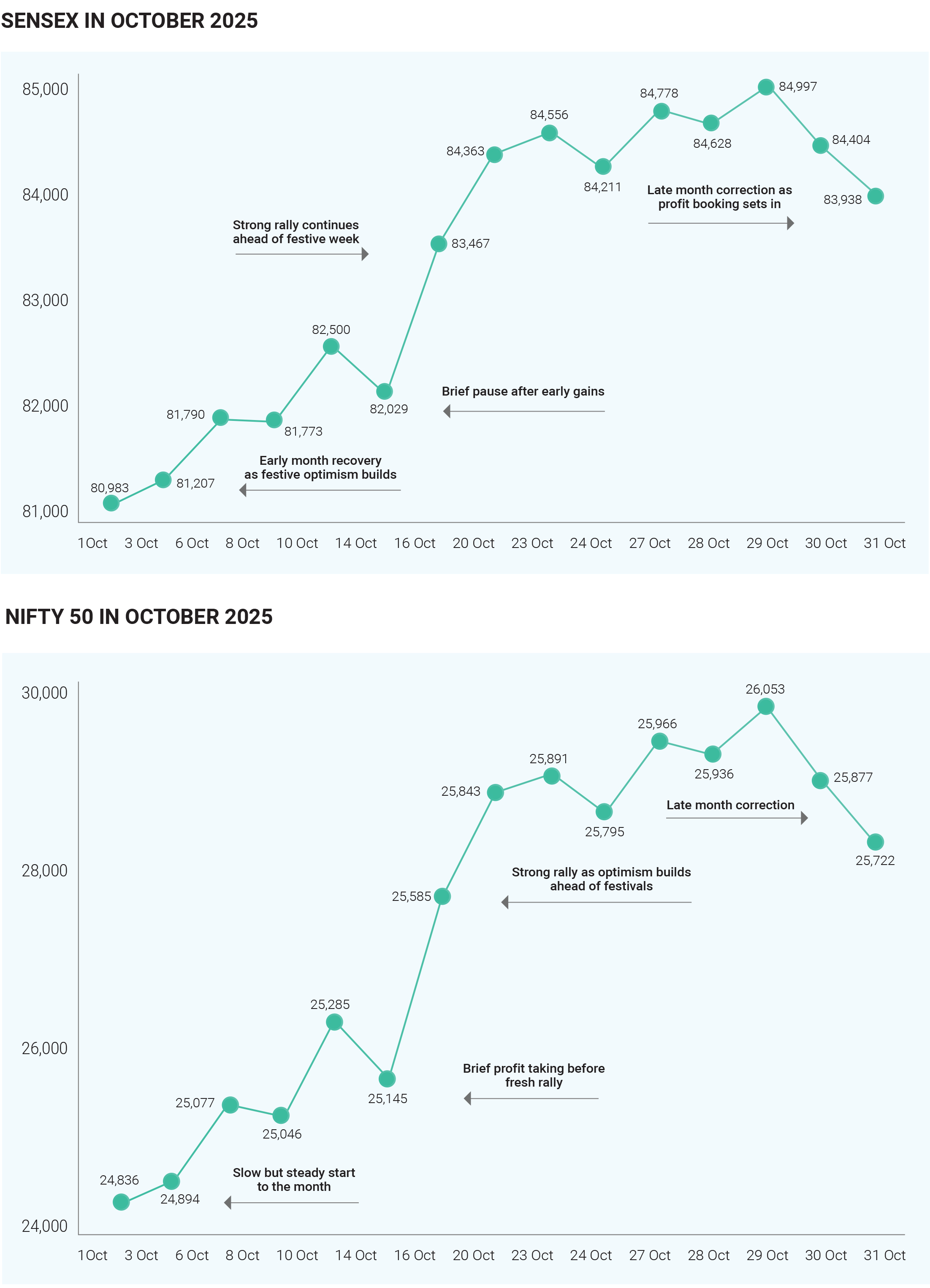

In October 2025, Indian equity markets demonstrated

remarkable resilience and strength, with both the Sensex

and Nifty registering strong monthly gains despite

closing the month on a slightly weaker note. The

market’s trajectory was defined by alternating phases of

optimism and caution—early enthusiasm fuelled by

robust corporate earnings and sustained foreign inflows

drove benchmarks to record highs, but profit-booking

and global headwinds toward the month’s end triggered a

mild pullback. This dual-phase performance captured the

complex balance between domestic growth optimism

and external vulnerabilities as investors navigated an

environment shaped by earnings momentum, regulatory

changes,

and

volatile

international

By October 31, 2025, the Sensex settled at 83,938.71,

down 0.55% for the day, while the Nifty closed at

25,722.10, slipping 0.60%. Despite these end-of-month

declines, both indices recorded impressive monthly

advances of nearly 5%—their best performance since

March 2025. The rally was largely fuelled by strong Q2

FY26 earnings and steady foreign portfolio inflows,

particularly into technology, public sector banking, and

telecom stocks such as Bharti Airtel, which touched

record highs during the period. Midcap and small-cap

segments also participated enthusiastically, signalling

broad-based investor confidence. However, the market’s

upward momentum moderated in the final week as

investors opted to lock in profits after sustained gains.

Banking and financial stocks came under notable

pressure following regulatory changes announced by

SEBI that affected Bank Nifty derivatives. Major private

lenders like HDFC Bank and ICICI Bank witnessed heavy

profit-taking, contributing to the overall market’s

weakness. Meanwhile, defensive segments such as

healthcare, pharmaceuticals, and metals also faced mild

declines, as investors rotated capital toward cyclical and

growth-oriented sectors during the earlier bullish stretch.

The Sensex and Nifty’s performance throughout the

month followed a clear pattern—strong early gains driven

by robust buying in IT and banking counters, followed by

a corrective phase triggered by global caution and

sectoral profit-booking. Despite the late weakness, PSU

banks and oil & gas companies provided crucial support,

helping markets sustain their monthly gains.

Global developments exerted significant influence on

market sentiment. Mixed signals from the U.S. Federal

Reserve, especially regarding the timing of potential rate

cuts, weighed on investor confidence. The Fed’s cautious

stance and a stronger U.S. dollar led to intermittent

foreign outflows, slightly dampening risk appetite.

Inflationary pressures in the U.S. and Europe prompted

further tightening by the Federal Reserve and European

Central Bank, temporarily unsettling global equity flows.

Weak global demand also persisted, particularly

affecting India’s export

oriented sectors such as IT, pharmaceuticals, and

textiles.

These

challenges

underscored

the

interconnected nature of Indian equities with global

macroeconomic dynamics, even as domestic

fundamentals remained robust.

On the domestic front, the Q2 earnings season played a

pivotal role in shaping market behaviour. Stellar results

from large-cap companies such as Tata Consultancy

Services (TCS) and strong operational updates from

several blue-chip firms boosted sentiment in the early

part of the month. The primary market also witnessed

heightened activity, with major IPOs like Tata Capital and

Groww attracting overwhelming investor participation.

These new listings diverted liquidity temporarily but

underscored the deepening retail and institutional

engagement in Indian equities. The influx of new capital

through IPOs and mutual fund inflows highlighted

investors’ growing confidence in India’s structural growth

story.

However, by the final week of October, the market’s

four-week winning streak came to an end as heavy

profit-booking set in. Small-cap stocks, however,

continued to outperform, reflecting investor appetite for

higher-risk, high-reward opportunities. Public sector

undertakings (PSUs), particularly in banking and energy,

emerged as notable outperformers, offering relative

stability amid the broader correction. Conversely, IT and

private banking counters, which had driven much of the

earlier rally, bore the brunt of the sell-off as valuations

turned rich and traders sought to lock in gains.

The interplay of these forces created a turbulent yet

opportunity-rich environment throughout the month.

Sector rotation was a key theme, with investors

dynamically shifting exposure between cyclical,

defensive, and value-oriented plays in response to

earnings updates, policy changes, and global signals.

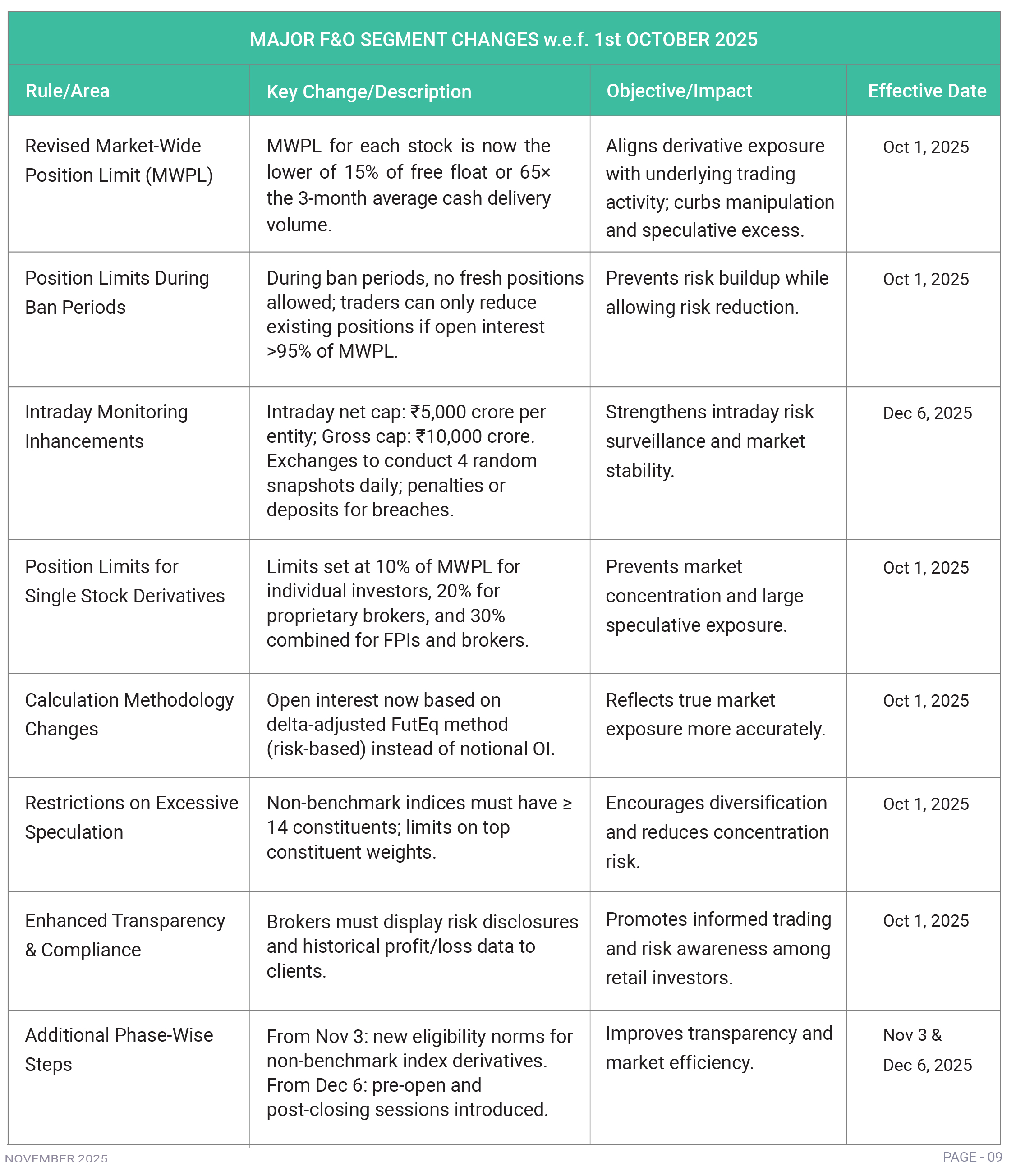

Among the primary reasons for the late-month correction

were profit-booking after a sustained rally and uneven

performance across key corporate earnings. Regulatory

announcements, including SEBI’s circular affecting large

private banks’ eligibility norms for derivatives, added to

banking sector uncertainty. Meanwhile, global central

banks’ cautious tone and the continued strength of the

U.S. dollar further deterred aggressive risk-taking by

foreign investors.

Despite these headwinds, the broader narrative remained

optimistic. The resilience of PSU banks and strength in

oil & gas counters reflected selective investor confidence

in value sectors. The buoyant IPO market and steady

mutual fund inflows pointed to deepening domestic

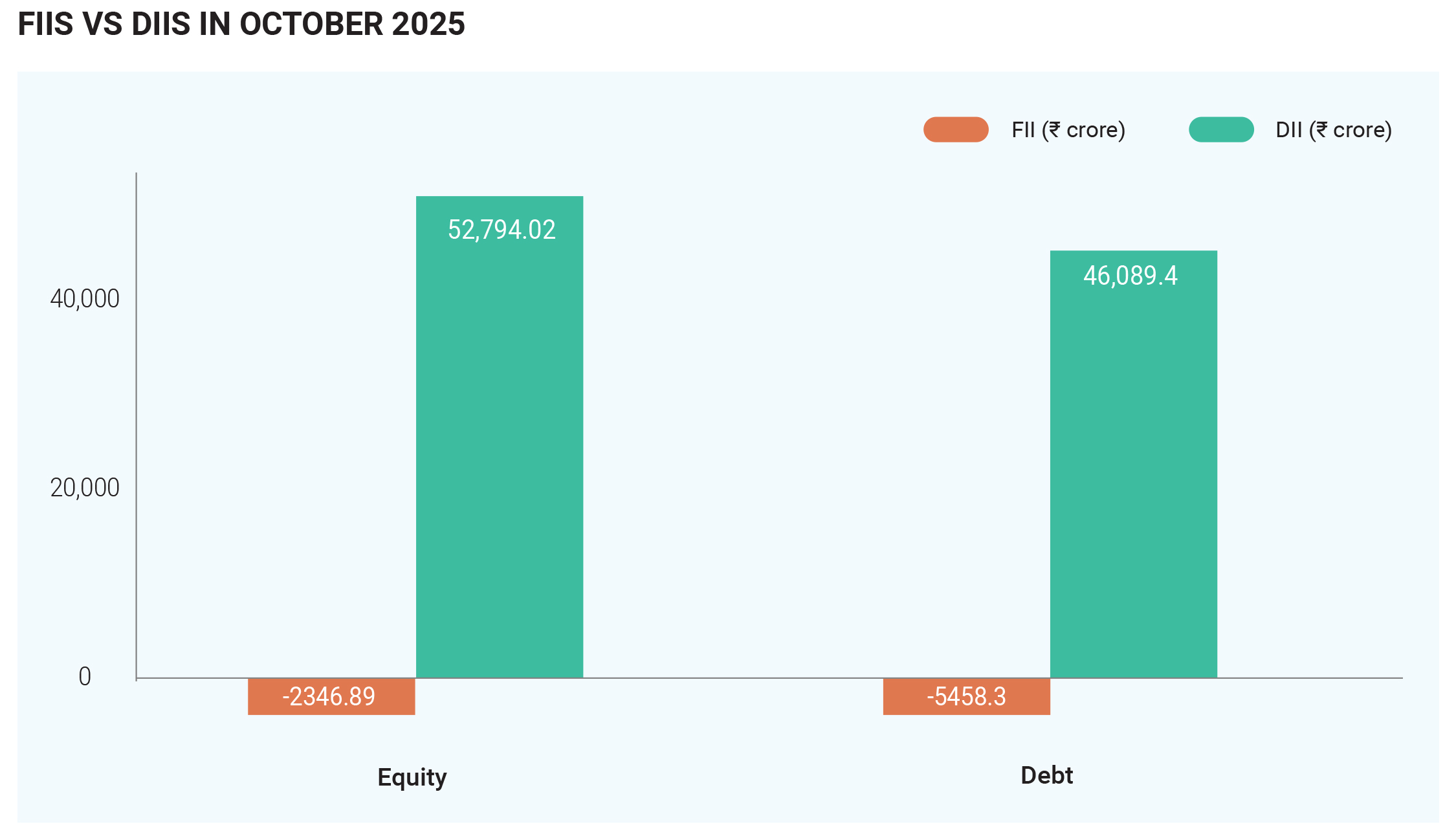

participation. Both foreign and domestic investors

played vital roles in sustaining the market’s strength.

After several months of outflows, Foreign Institutional

Investors (FIIs) returned as net buyers, while Domestic

Institutional Investors (DIIs) maintained consistent

support through steady inflows. This combined

participation helped markets absorb volatility effectively.

FIIs, who had been net sellers from July to September,

reversed course in mid-October, recording their first

positive monthly inflow since June 2025. They

collectively purchased around ₹10,040 crore during the

month, signalling renewed confidence in India’s

macroeconomic prospects. The standout moment came

on October 28, when FIIs logged their largest single-day

purchase—over ₹10,300 crore—marking a decisive shift

from the selling trend of previous months. DIIs remained

steadfast, adding approximately ₹9,537 crore in net

inflows by month-end. Their steady buying offset early

volatility from FIIs and provided a stabilizing cushion

during periods of profit-taking. FIIs particularly increased

exposure to state-run banks, aligning with the PSU

banking rally, while DIIs favoured financials and

consumer-oriented sectors. The revival in FII sentiment

was primarily driven by expectations of a potential U.S.

Federal Reserve rate cut, moderation in the U.S. dollar,

and resilient domestic earnings. Meanwhile, DIIs

continued to deploy funds through systematic

investment plans (SIPs) and tactical sectoral allocations.

Together, these trends underscored renewed global and

domestic confidence in Indian equities.

In conclusion, October 2025 epitomized the dual nature

of India’s stock markets—buoyed by strong domestic

fundamentals

and

corporate

performance

yet

periodically tested by global uncertainties and regulatory

developments. Despite short-term volatility, both the

Sensex and Nifty posted commendable monthly gains of

about 5%, reaffirming India’s standing as one of the most

resilient and attractive investment destinations amid

global turbulence. While short-term consolidation may

persist, the medium-term outlook for equities remains

positive, underpinned by steady economic growth, robust

earnings momentum, and expanding retail investor

participation.

In October 2025, India’s debt market demonstrated

resilience and underlying strength, showing stability to

mild positivity across most segments. While government

bond yields edged slightly higher, the broader sentiment

remained constructive, supported by expectations of a

forthcoming rate-cut cycle and strong demand for

corporate debt. The month reflected a delicate balance

between global uncertainty and domestic optimism, as

both institutional investors and corporates responded to

improving liquidity conditions and policy clarity.

The 10-year benchmark government bond yield rose

modestly by about 6 basis points to close at 6.59% at the

end of October, marking a slight month-on-month uptick

but remaining well below levels seen a year earlier. This

marginal rise was largely in line with global trends, where

U.S. Treasury yields also adjusted amid evolving

expectations of monetary easing in major economies.

Despite the upward movement, investor appetite for

government securities stayed intact, aided by stable

inflation data and signs of fiscal prudence from the

Indian government.

Corporate bond activity, meanwhile, rebounded sharply

after a subdued July–September quarter. October

witnessed fresh issuances exceeding ₹1 trillion,

highlighting renewed confidence in the credit markets.

The resurgence was anchored by large-scale offerings, such

as Bharti Telecom’s ₹105 billion and the State Bank of India’s

₹75 billion bond sales, both of which saw strong investor

participation. Market optimism surrounding an eventual

Reserve Bank of India (RBI) rate cut and a benign inflation

outlook spurred this revival, encouraging issuers to lock in

funds at relatively favourable rates.

Money market instruments and short-duration debt funds

also performed steadily during the month. Continued

liquidity support from the RBI and limited concerns over

inflation or fiscal slippage kept yields on short-term

instruments contained. The overnight call money rate and

commercial paper yields moved in a narrow band, reflecting

healthy systemic liquidity and balanced demand-supply

conditions.

A key highlight of October was the renewed interest from

foreign investors. Foreign Portfolio Investors (FPIs)

registered net inflows exceeding ₹15,000 crore into Indian

debt under the Fully Accessible Route (FAR)—a sharp

contrast to the muted participation observed earlier in the

year. With global growth slowing and major central banks

expected to pivot toward easing in 2026, India’s relatively

high-yielding bonds became increasingly attractive to

overseas investors seeking stable returns in emerging

markets.

The moderate uptick in government yields was

influenced by global cues, as economic data from the

U.S. and Europe signalled weakening momentum, raising

the likelihood of synchronized global rate cuts in the near

term. Domestically, the Reserve Bank of India maintained

the repo rate at 5.5% during its October policy meeting

but struck a notably dovish tone, acknowledging

softening inflation and hinting at a supportive monetary

stance going forward. This policy communication

provided a strong tailwind for corporate bond markets,

fuelling optimism about a lower cost of borrowing in the

coming quarters.

Additionally, fiscal developments contributed positively

to market sentiment. The government’s commitment to

fiscal discipline, including rationalized GST rates and a

lower-than-expected borrowing program for the second

half of FY26, reassured investors about manageable

deficit levels. Inflation remained within the RBI’s comfort

zone, and the absence of major supply-side shocks

further strengthened the case for potential monetary

easing.

Overall, October 2025 was a constructive month for

India’s fixed-income landscape. Government bond yields

saw only a mild increase, while corporate debt markets

experienced robust revival, underscored by strong

issuance volumes and renewed investor appetite. Steady

liquidity conditions, restrained inflation, and positive

policy signals combined to foster a favourable

environment for both issuers and investors. With growing

foreign

participation and

improving

domestic

confidence, the outlook for India’s debt market remains

optimistic, positioning it as a key beneficiary of the

anticipated global shift toward lower interest rates in the

months ahead.

In October 2025, the Indian Rupee (INR) remained largely

stable but exhibited a slight weakening trend against the

U.S. Dollar amid mixed global and domestic developments.

Throughout the month, the rupee traded in a narrow range

between 87.74 and 88.86 per U.S. dollar, reflecting resilience

despite global dollar strength and fluctuating capital flows.

The currency ended the month near 88.72 per dollar, marking

a modest depreciation of about 0.10% compared to

September. This marginal decline underscored the rupee’s

relative stability even as emerging market currencies broadly

weakened under a strong dollar environment.

During the month, the highest exchange rate was recorded

around ₹88.87 per U.S. dollar on October 9, indicating

moments of pressure linked to global risk aversion and

foreign portfolio outflows. Conversely, the rupee touched its

monthly low near ₹87.74 on October 22–23, when a brief

bout of strength emerged following Reserve Bank of India

(RBI) intervention and a pullback in global crude prices.

Despite minor intraday and weekly fluctuations, the currency

remained within a tight range, demonstrating that active

market management and strong fundamentals helped

contain volatility.

The rupee’s movement was influenced by a mix of domestic

and international factors. Globally, the U.S. Federal Reserve

maintained a cautious stance on interest rate cuts, signalling

patience despite signs of slowing economic growth. This

policy approach kept the dollar relatively firm, reducing the

appeal of emerging market currencies. Additionally, lingering

trade deficit concerns and uneven foreign capital flows

exerted intermittent pressure on the rupee.

A major event that shaped currency dynamics was the RBI’s

active intervention in the forex market. On October 15, the

central bank sold U.S. dollars aggressively to curb

speculative demand, leading to the rupee’s sharpest

single-day gain—about 0.8%—in nearly four months. This

move highlighted the RBI’s commitment to managing

volatility rather than defending any fixed level. Such timely

interventions reassured market participants and prevented

excessive depreciation pressures. India’s macroeconomic

fundamentals also provided a strong buffer. With GDP

growth of 7.8% in Q1 FY26, inflation remaining within the

central bank’s comfort range, and foreign exchange reserves

exceeding $700 billion, India’s economic position remained

sound. The current account deficit, contained at around 1%

of GDP, further supported currency stability. These factors

collectively enhanced investor confidence and limited

speculative pressures on the rupee.

In summary, October 2025 was a month of cautious stability

for the Indian rupee. The currency’s slight depreciation

reflected external pressures from a firm U.S. dollar and

global uncertainty, but strong domestic fundamentals,

proactive RBI interventions, and a contained current account

deficit helped prevent any significant weakness. With

resilient macroeconomic indicators and ongoing policy

initiatives, the rupee remained fundamentally stable and

well-positioned to withstand global volatility heading into the

final quarter of 2025.

Crude oil prices in October 2025 experienced persistent

downward pressure, marking the third consecutive

month of decline. Prices fell by about 2.2% during the

month, sliding from approximately $65.36 per barrel at

the beginning of October to around $63.90 per barrel by

month-end, with the lowest point recorded mid-month

near $61.02 per barrel. The month’s movement reflected

a confluence of bearish supply-demand fundamentals,

rising inventories, a strong US dollar, and muted demand

growth across key global economies. Despite

intermittent geopolitical tensions offering temporary

support, the broader sentiment in the oil market

remained cautious and tilted to the downside.

In the first week of October (October 1–7), crude prices

began around $65.36 and weakened slightly as the

market anticipated a significant OPEC+ production hike

of around 500,000 barrels per day starting in November.

Expectations of this additional supply, coupled with

softer refinery demand and the onset of seasonal

consumption decline, outweighed geopolitical concerns

that might have otherwise supported prices. Traders also

factored in the likelihood of continued output growth

from non-OPEC producers, setting a subdued tone early

in the month. During the second week (October 8–14),

Brent crude briefly approached a mid-month high near

$66.40 on October 8 before retreating amid choppy and

bearish trading conditions. A key catalyst for the decline

was the unexpected surge in US crude inventories, which

signalled that supply continued to outpace demand. The

build-up in inventories raised concerns about a potential

supply glut, dampening market optimism. Even as

geopolitical risks persisted in parts of Eastern Europe

and the Middle East, they failed to generate sustained

price gains, as investors focused on the broader

oversupply narrative and weaker refining margins. The

third week (October 15–21) saw the steepest drop of the

month, with crude prices tumbling to a low of around

$61.02 per barrel on October 20. This phase was

characterized by pronounced bearish momentum driven

by abundant supply and limited demand growth. OPEC+

production remained high, while US shale producers

continued to expand output. Meanwhile, large stockpiles

both onshore and in floating storage underscored market

oversaturation. Demand uncertainty from major

consumers, particularly China—where industrial activity

showed signs of slowing—further weighed on sentiment.

The combination of rising output, soft consumption, and

excess inventories created a decisive downward turn in

prices. In the final week of October (October 22–31),

crude oil prices showed signs of stabilizing but remained

subdued. Market participants reacted to reports of fresh

US sanctions on Russian oil companies and regional

geopolitical tensions, but these factors offered only

fleeting price support. A robust US dollar added to the

downward pressure, as it made oil more expensive for

holders of other currencies, curbing international

demand. OPEC+ confirmed another output increase

planned for December but indicated a pause in

production hikes for early 2026, providing mild

reassurance to traders that the supply surge might soon

moderate.

Overall, October 2025’s oil market was defined by the

interplay of rising global supply, weakening demand, and

macroeconomic headwinds. Production from both

OPEC+ and non-OPEC nations continued to rise, creating

an oversupplied market environment. Demand growth

slowed, particularly in OECD countries and China, as

global energy transitions and efficiency measures

curtailed consumption. The strengthening of the US

dollar compounded price pressures, while rising

inventories across the US and other regions signalled

slackening demand momentum. Although geopolitical

uncertainties—such as tensions involving Russia and

Iran—offered temporary support, they were insufficient to

offset

the prevailing

bearish

fundamentals.

Consequently, October closed as another challenging

month for crude benchmarks, reinforcing the perception

of a well-supplied market grappling with a fragile demand

recovery and a stronger dollar backdrop.

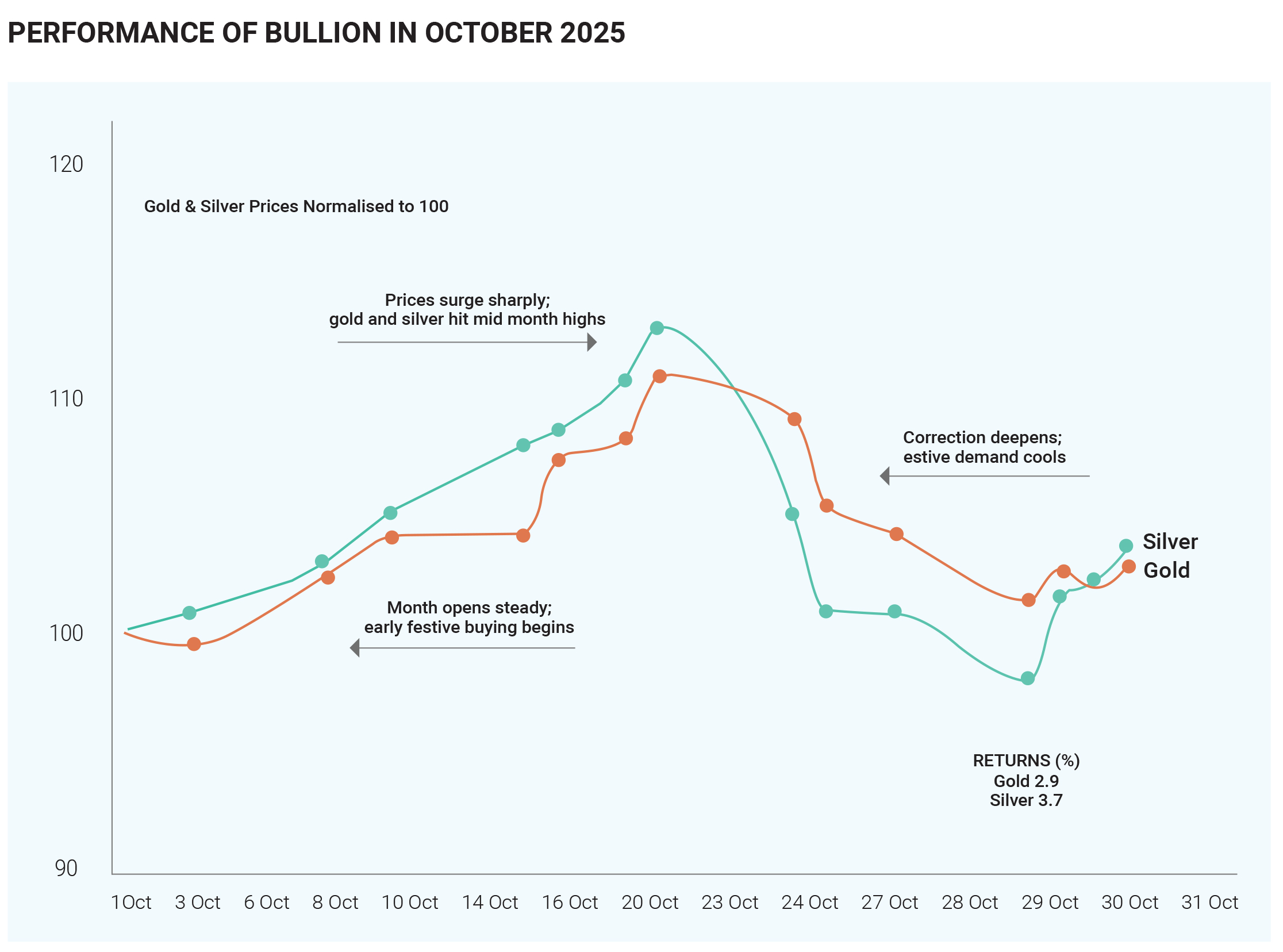

In October 2025, gold and silver prices in India reflected a

dynamic mix of festive enthusiasm, currency

movements, and global precious metal trends. Both

metals witnessed strong mid-month rallies fuelled by

domestic demand and safe-haven buying before easing

slightly toward the end of the month. The festive period

surrounding Diwali, a key driver of India’s gold and silver

consumption, coincided with global uncertainties and a

softer rupee, creating the perfect setup for a price surge

in both commodities.

Gold began October on a steady note around ₹11,900 per

gram but soon gathered upward momentum as robust

jewellery demand emerged ahead of the festive season.

The rupee’s mild depreciation further added to the local

price rise, as it made imported bullion more expensive.

By mid-October 24-carat gold touched an all-time high of

approximately ₹13,277 per gram, mirroring the global

rally that saw international prices breach the $4,000 per

ounce mark. The surge was underpinned not only by

Indian festive buying but also by sustained central bank

accumulation worldwide, as policymakers sought to

diversify reserves amid economic and geopolitical

uncertainties. However, the rally lost some steam in the

second half of the month. As the festive fever cooled and

global bullion prices corrected modestly, Indian traders

engaged in profit booking. By the end of October, gold

had stabilized around ₹12,200 per gram—still

significantly higher than its early-month level, signalling

resilient underlying demand. Overall, the month

reaffirmed the strong seasonal influence of Indian

consumers on gold prices and highlighted how global

and domestic factors often converge to shape

short-term trends in bullion markets.

Silver followed a similar trajectory but with even sharper

swings. The metal started the month trading near

₹1,51,000 per kg and experienced a steep surge through

the first half of October. Around October 13, silver

climbed to about ₹1,85,000 per kg, and within just two

days, it spiked further to nearly ₹1,90,000 per kg, marking

one of the sharpest short-term gains in recent months.

This rally was driven by festive-season demand,

heightened investment interest, and a weaker rupee,

which inflated import costs. Silver’s dual role as both an

industrial and investment metal also attracted buyers

seeking diversification and inflation protection amid

global market volatility. Toward the month’s end, some

cooling occurred as traders booked profits and retail

buying normalized. Even so, silver remained well above

its early October levels, underscoring sustained investor

confidence and festive-led demand momentum that kept

the metal shining bright through October 2025.

October 2025 was a dynamic month for the Indian

mutual fund industry, marked by strong equity inflows,

steady growth in hybrid schemes, and cautious

sentiment toward debt funds. Despite global

uncertainties and volatile market cues, investors

displayed sustained confidence in domestic equities,

driven by robust corporate earnings and resilient market

performance. The overall industry maintained a healthy

growth

trajectory,

underscoring

the

deepening

penetration of mutual funds across investor categories

and geographies.

Equity mutual funds were the standout performers in

October, attracting net inflows of around ₹14,610 crore.

This surge reflected rising investor optimism as the Nifty

index advanced by 4.51% during the month, supported by

solid quarterly results and strong institutional buying.

Sectoral and thematic funds saw particularly impressive

traction, led by themes such as technology, electric

vehicles, and artificial intelligence. Large-cap funds,

meanwhile, provided stable long-term performance, with

top performers such as Nippon India Large Cap Fund

posting 8.4% annual and over 26% five-year returns,

highlighting their consistency and defensive strength.

The overall trend in equity fund flows indicated sustained

retail participation, buoyed by rising SIP (Systematic

Investment Plan) contributions and growing investor

trust in long-term wealth creation through equities.

Debt mutual funds, on the other hand, experienced net

outflows of approximately ₹20,987 crore in October.

Investors

adopted a cautious stance toward

fixed-income assets amid flat bond yields around 6.5%

and lingering concerns about potential interest rate

volatility. The lack of meaningful movement in yields,

combined with quarter-end portfolio adjustments, led to

redemptions across several short-duration and liquid

fund categories. Although fixed-income AUM expanded

over the year due to base effects, the near-term

sentiment remained subdued as investors preferred

equity and hybrid exposure in anticipation of better

returns.

Hybrid funds emerged as a key beneficiary of market

uncertainty, registering healthy inflows of around

₹20,987 crore. Investors continued to favour aggressive

and

balanced hybrid schemes, which offered

diversification benefits by combining equity upside

potential with the relative stability of debt. The growing

popularity of these funds reflected a preference for

moderated risk amid volatile equity conditions.

At the industry level, assets under management (AUM)

reached a record ₹75.61 lakh crore by September 2025,

up 12.7% year-on-year. Monthly SIP inflows touched

₹29,361 crore, marking a 20% rise from the previous year

and signalling deepening investor participation. Equity

funds accounted for about 61% of total AUM, while

passive

funds—including

index

funds

and

ETFs—expanded their share to 17%, driven by cost

efficiency and rising investor awareness. Notably,

smaller asset management companies outside the top

15 continued to gain market share, suggesting a more

competitive and inclusive fund landscape.

In summary, October 2025 underscored the resilience

and maturity of India’s mutual fund industry. Equity and

hybrid funds thrived on strong market momentum, SIP

growth, and investor optimism, while debt funds faced

redemptions amid stagnant yields. The overall picture

reflected a sector in transition—balancing growth with

prudence—as investors diversified across active,

passive, and hybrid strategies to navigate evolving

market conditions.

In October 2025, India’s insurance sector exhibited

strong growth and structural transformation across life,

health, and general insurance segments, supported by

rising consumer awareness, digital innovation, and

economic expansion. The life insurance segment

continued its positive trajectory, recording a 5.1%

year-on-year rise in New Business Premiums (NBP) for

FY 2025, reaching ₹3.97 lakh crore. Individual NBP

increased by 11% to ₹1.74 lakh crore, driven by robust

new agent recruitment—over 11 lakh additions—and

accelerated digitization across distribution channels.

While private insurers led this growth with new product

offerings and improved customer engagement, the Life

Insurance Corporation (LIC) experienced marginal

declines in certain key categories due to ongoing

product realignments and regulatory adjustments in

commissions and surrender values.

In the non-life segment, health and motor insurance were

major growth drivers. Private players like ICICI Lombard

reported an 18% year-on-year profit increase in Q2 FY25,

fuelled by a 50% surge in retail health premiums and a

10% uptick in motor insurance after tax reductions in the

auto sector. Rising healthcare costs and post-pandemic

awareness continued to boost health insurance

demand. However, public sector general insurers faced

weaker underwriting performance and solvency

constraints, while private firms expanded aggressively

with strong capital positions.

Looking ahead, India’s insurance industry is projected to

grow to ₹19.3 lakh crore (US$222 billion) by FY26,

supported by digital reforms, AI-driven automation, and

broader rural outreach through platforms like IRDAI’s

“Bima Sugam.” Emerging trends such as IoT-based

insurance—expected to grow at 55% CAGR to ₹1.83 lakh

crore

by

2033—underscore the sector’s rapid

technological evolution.

Copyright © 2021 Fintso