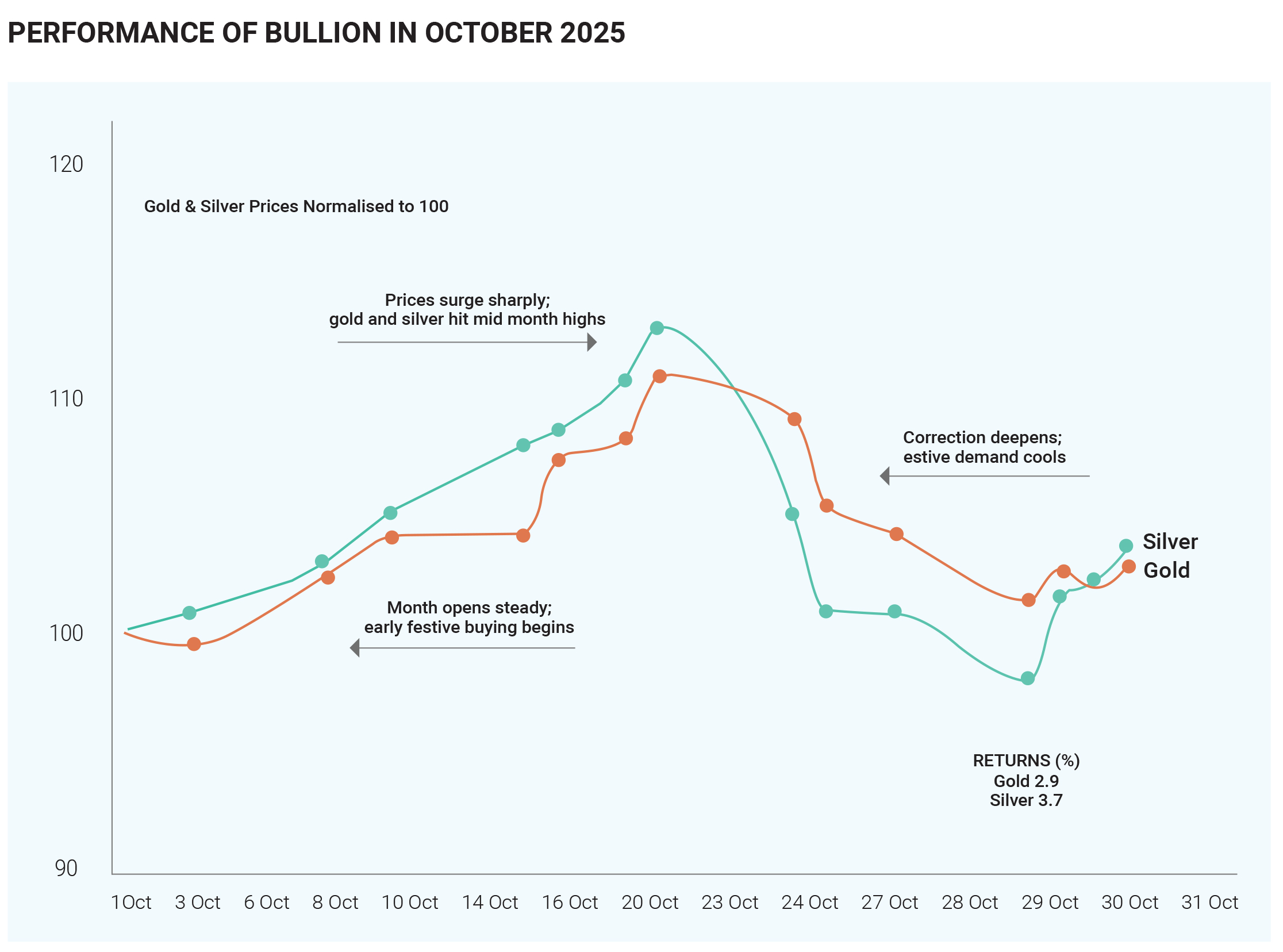

In October 2025, gold and silver prices in India reflected a

dynamic mix of festive enthusiasm, currency

movements, and global precious metal trends. Both

metals witnessed strong mid-month rallies fuelled by

domestic demand and safe-haven buying before easing

slightly toward the end of the month. The festive period

surrounding Diwali, a key driver of India’s gold and silver

consumption, coincided with global uncertainties and a

softer rupee, creating the perfect setup for a price surge

in both commodities.

Gold began October on a steady note around ₹11,900 per

gram but soon gathered upward momentum as robust

jewellery demand emerged ahead of the festive season.

The rupee’s mild depreciation further added to the local

price rise, as it made imported bullion more expensive.

By mid-October 24-carat gold touched an all-time high of

approximately ₹13,277 per gram, mirroring the global

rally that saw international prices breach the $4,000 per

ounce mark. The surge was underpinned not only by

Indian festive buying but also by sustained central bank

accumulation worldwide, as policymakers sought to

diversify reserves amid economic and geopolitical

uncertainties. However, the rally lost some steam in the

second half of the month. As the festive fever cooled and

global bullion prices corrected modestly, Indian traders

engaged in profit booking. By the end of October, gold

had stabilized around ₹12,200 per gram—still

significantly higher than its early-month level, signalling

resilient underlying demand. Overall, the month

reaffirmed the strong seasonal influence of Indian

consumers on gold prices and highlighted how global

and domestic factors often converge to shape

short-term trends in bullion markets.

Silver followed a similar trajectory but with even sharper

swings. The metal started the month trading near

₹1,51,000 per kg and experienced a steep surge through

the first half of October. Around October 13, silver

climbed to about ₹1,85,000 per kg, and within just two

days, it spiked further to nearly ₹1,90,000 per kg, marking

one of the sharpest short-term gains in recent months.

This rally was driven by festive-season demand,

heightened investment interest, and a weaker rupee,

which inflated import costs. Silver’s dual role as both an

industrial and investment metal also attracted buyers

seeking diversification and inflation protection amid

global market volatility. Toward the month’s end, some

cooling occurred as traders booked profits and retail

buying normalized. Even so, silver remained well above

its early October levels, underscoring sustained investor

confidence and festive-led demand momentum that kept

the metal shining bright through October 2025.